FAQ

Frequently Asked Questions

General Questions

A stake pool is a reliable block-producing server node that holds the combined stake of various stakeholders in a single entity (it pools the stake that has been delegated to it). Stake pools are responsible for processing transactions and producing new blocks and are at the core of Ouroboros, the Cardano proof-of-stake consensus protocol.

To be secure, Ouroboros requires a good number of ADA holders to be online and maintain sufficiently good network connectivity at any given time. This is why Ouroboros relies on stake pools, entities committed to run the protocol 24/7, on behalf of the contributing ADA holders. In return, pool owners and participating ADA holders will earn rewards.

Each stake pool can have one or more owners who are determined early on before the pool is registered. Owners can pledge to the pool, using either some or all of their own stake, to make it more attractive to other delegators, though this is not required. Separately, a stake pool operator is assigned responsibility for setting up and keeping the stake pool running. First, the stake pool operator sets up a stake pool node, which is a Haskell node that has been configured to produce and validate blocks from the Cardano blockchain.

Once a stake pool is set up and ready for use, it must be registered on the blockchain. All stake pools must be registered and registration information is recorded on-chain. The stake pool owners may also choose to register the pool with one or more stake pool registries. These registries are maintained off-chain and are used to compile lists that distinguish stake pools within the Daedalus wallet interface and other tools and web sites. However, it is important to note that being part of a registry is not mandatory, and anyone with enough ADA to pay the transaction fee can set up a stake pool, even if they are not listed in any registry. ADA holders may also choose to subscribe to the registries of their choice, or to no registry at all. An ADA holder can then go to Daedalus and select the stake pool to which they want to delegate their stake, in the Delegation tab. That delegation action is recorded on the Cardano blockchain and assuming it is recorded sufficiently early in the epoch, may influence the slot leader selection process in the next epoch and beyond.

The Cardano node is the core component that underpins the Cardano network. A blockchain network is a collection of interconnected nodes, all working together to validate transactions and blocks by means of consensus. The definition of consensus for any given network varies, but for the Cardano network it’s defined by the Ouroboros protocol. By running a Cardano node, users participate in and contribute to the security and decentralization of the network.

A Cardano node can be configured to act as a block producer node (read stake pool) or as relay node.

Every Cardano node keeps its own copy of the ledger (bookkeeping of financial transactions).

Relay nodes are communicating with other nodes in the network and their role is forwarding blocks with transactions, next to this purpose they are shielding (securing) the stake pool from public exposure to the network.

A stake pool (or block producer node) gets slots assigned by a lottery mechanism embedded in the Ouroboros protocol, these slots represent a block that is forwarded by its relay nodes from the public network. A stake pool has the role to verify an assigned block with transactions. Verification of the block with transactions is done on basis of cryptography and the outcome tells if the block with transactions is tampered or not. The result of this verification process is broadcasted to the public network by its relay node. Only when the majority of the nodes in the network agree that the outcome of the verification is correct and the block with transactions is not tampered, the stake pool can create this block and append it to the ledger. For this action the stake pool will receive a reward that is being shared between the stake pool owner and the stake holders in the stake pool.

Below we summarized reasons why we think that delegating your stake with JUNO is a good choice.

- We have an excellent resilient infrastructure for our stake pool that is build up in different data centers and availability zones in Europe and the USA to guarantee nearly 100% uptime 24/7/365. For you this means, we will be able to forge blocks at any time in case they are offered to our stake pool by the Ouroboros protocol.

- Our infrastructure is build on basis of microservices, this gives us the flexibility to easily update, deploy and scale without being dependent on the underlying operating system and cloud services provider

- We run a single stake pool and are actively contributing to the Cardano ecosystem in the form of open source contributions, solution provider and Plutus/Haskell development partner of IOHK

- We have a very knowledgeable stake pool operator with over 25 years experience in IT, with profound linux and security knowledge

- Ron is a serial entrepreneur and running multiple IT companies (established and startups). These companies develop enterprise grade solutions for their clients on basis of the open source code in the areas of machine learning, artificial intelligence, internet of things and blockchain. The majority of these solutions is cloud native and mobile

- We have a background in developing blockchain solutions on Ethereum which we are still running for our clients. This means we have profound knowledge of blockchain and smart contracts and know exactly what to do and what not when building blockchain based solution

- We have committed ourselves to the Cardano blockchain, we are developing community and commercial grade solutions on top of it

- We can piggy back on the experience and knowledge of our experienced development teams

- We have our own Telegram and Youtube channel to inform and teach the community about Cardano and our stake pool

- We are actively marketing our stake pool to attract more stake

By delegating your stake to a stake pool you can earn ADA.

You could start your own private pool or public pool to earn ADA for validating blocks on the Cardano network but this isn’t so easy. Most people either don’t have enough ADA or missing the knowledge to do this. Beside the fact that running a stake pool is taking a lot of time and expenses are applicable for infrastructure, marketing and labor.

So for those people staking with a stake pool is a better choice to earn ADA.

Their delegated ADA will be used by the stake pool to increase the total stake pool stake, more stake means higher chances for the stake pool to forge blocks.

Forging blocks means, the option to validate a block and the financial transactions within that block. Validation is done on basis of cryptographic algorithms, with those we can determine if a transaction within the block or the block itself is being tampered. The Ouroboros protocol will determine at the start of an epoch how many blocks will be distributed to a stake pool to be validated on basis of the total amount of stake within the stake pool.

Once the stake pool forges a block and determines that the block (with financial transactions) is not tampered it will broadcast the result to other nodes in the network. Those nodes will validate the outcome. Once the majority of the node return that the outcome i correct the stake pool will receive a reward for its validation.

The rewards the pool received are being shared with its delegators.

The role of the stake pool is to secure the network by validating transactions, for this is needs to guarantee nearly 100% uptime 24/7/365. Indirectly the delegator is contributing to the security of the Cardano blockchain network.

Pool pledge is the stake that the stake pool owner put in their stake pool.

It is like an investment in stake by the stake pool owner(s), an initial stake amount also known as “skin in the game” or commitment to the Cardano blockchain.

A stake pool owner that has a lot of pledge into their stake pool either has a lot of money or is committed to the project for the long term. A stake pool with limited pledge has zero to no commitment to the project since they are not willing to commit themselves to the project, this could be they are in it to earn quickly some money and stop their stake pool at any moment when they succeed in this.

JUNO has committed itself for the long term to the Cardano project by initially pledging 350K ADA we hope to increase this amount over time. The 350K pledge is locked for a minimum of 3 years, which means this is guaranteed by the owner(s) to stay in the stake pool for that period.

If the pledge is taken out by the owner(s) the stake pool will get punished for this influencing directly the stake rewards the stake pool is receiving. Indirectly this will hurt the delegators to the stake pool, this is not what we want.

Since JUNO is developing community and commercial solutions on the Cardano blockchain it makes sense for us to commit ourselves to this project since we want it to succeed. But of course not everyone has unlimited funds available to lock for a longer time. We hope to get enough support from the community to gradually increase the pledge.

For a delegator it is important to stake with a stake pool that has a long term commitment to the Cardano blockchain and has a plan in place regarding their pledge. It is better to stake with a stake pool that has a certain amount of ‘skin in the game’ since this guarantees that the stake pool is investing in the ecosystem and not cash cowing.

Fixed costs are costs related to infrastructure (computers, ups, energy etc.) to run a stake pool.

The minimum amount of fixed costs is 170 ADA per epoch, which is determined by the IOHK the company that is developing the Cardano blockchain. Stake pool owner are free to increase this amount on basis of their actual infrastructure and energy costs to run the stake pool.

JUNO is working with the minimal amount of 170 ADA per epoch since epoch 449 and it will stay stay at least like this till the end of Q1 2024 after which we will re-evaluate the status of the network.

Delegators will receive more rewards by staking with a stake pool with the minimum fixed costs then staking with a stake pool that maintained the 340 ADA per epoch as was the minimum before epoch 449.

For a delegator it is important to understand that not every stake pool is running with the same equipment, so costs related to a stake pool could vary. Some stake pool operators are running their stake pool on home equipment with limited or no resilience, thus for them the 340 ADA per epoch is a royal reward. Actually they are not delivering value towards their delegators since block production could go easily in jeopardy.

Other stake pools may run their infrastructure in the cloud at a service provider either on Virtual Private Servers or on Bare Metal Servers.

JUNO’s pool infrastructure is running on Bare Metal Servers in the cloud and at home, we are making use of different data centers and availability zones to guarantee an excellent resilience and near to 100% uptime to deliver high quality stake pool services to the best rewards for their delegators.

A delegator should be able to trust on a stake pool that it is striving for 100% uptime under all circumstances, since this will deliver the best rewards. So it is good to ask yourself to what stake pool you are staking. What does their hardware infrastructure look like?

A stake pool margin is required to operate the stake pool.

Lots of work is involved in installing, maintaining and optimizing the stake pool infrastructure to ensure that the stake pool has nearly 100% uptime. This is work that has to be done by the stake pool operator and this is an expense.

Next to this the stake pool needs to be promoted to attract new delegators. For this campaigns and content has to be developed and to be executed. Either the stake pool owners do it themselves or they have to hire people for this. A lot of expenses are involved in this process.

To cover these expenses the stake pool owner is calculating a margin over all the rewards produced by the stake pool, to somehow be able to cover these expenses (although most pools are running at a loss since the stake pool rewards are too small that the pool margin can cover the expenses being made)

As a delegator you should look into the effort a stake pool is putting into their infrastructure and marketing. This gives a good indication if the stake pool has a commitment to succeed.

You will receive your rewards automatically in your wallet from which you delegated your stake to the stake pool on basis of the Delegation Cycle.

The stake pool owner is not responsible for this distribution, the distribution of rewards is automatically done on basis the snapshot being made at the begin of the Delegation Cycle by the Ouroboros protocol. With the snapshot the percentage of stake in the stake pool is determined for every individual delegator. Payment of rewards is done after two epochs on basis of the rewards the stake pool collected by forging blocks, the total rewards minus fixed costs minus margin times your stake percentage will be automatically distributed to your staking wallet.

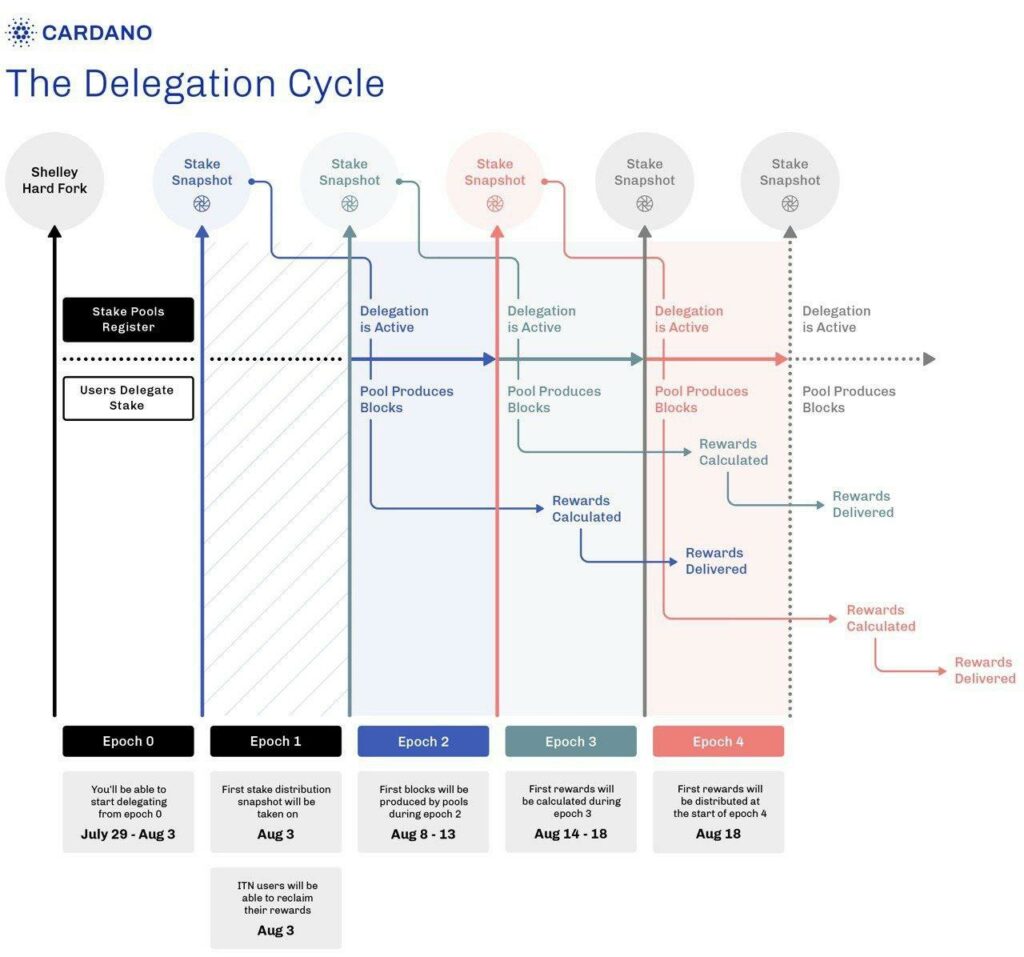

The Delegation Cycle is a mechanism that is used by the Ouroboros protocol to make a stake snapshot of the stake pool its total stake.

At the begin of an epoch (cycle of 5 days) a snapshot is take to determine the total amount of stake of the stake pool and the individual delegators stake in the stake pool to be able to determine the percentage of stake rewards.

It takes exactly one epoch before a delegators stake becomes active in a stake pool, during this period a new delegator will not get any rewards unless the delegator has staked before with another stake pool it might still receive rewards from the other stake pool.

It takes exactly two epochs after the stake of the delegator became active before rewards are being delivered to the delegators wallet, in case the stake pool is forging blocks.

In below figure the Delegation Cycle is visualized.