Delegator logic. What are we missing?

What are we missing in understanding the logic behind delegators?

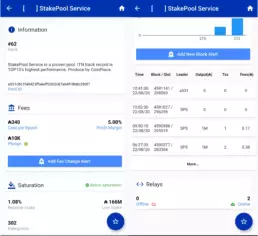

In below example we are making a comparison between an anonymized stake pool and our stake pool A4PEU (JUNO) .

Characteristic anonymized stake pool

Profit margin 5%

Fixed costs per epoch 340 (Minimum required)

Pledge 10K ~ 1.300 USD

Relays 2

Stake 166 M

![Information about our Cardano stake pool A4PEU [JUNO]](https://junostakepool.com/wp-content/uploads/2020/08/pool-logic-A4PEU-blogcontent-scaled-uai-258x236.webp)

Characteristics A4PEU stake pool

Profit margin 4.25% automatically returned in the pool for 3 years

Fixed costs per epoch 340 ADA (Minimum required)

Pledge 350 K ~ 45.500 USD

Relays 6 (exclusive hidden relays)

Stake 3.2 M

It is obvious that we are don’t have enough delegators to forge enough blocks on a regular basis, although the statistics tells something else, reality seems to be different.

In our opinion our pool parameters are much more in favor for delegators than those of the anonymized pool. We have a long time commitment, hence our pool pledge is locked for minimal 3 years and the pool rewards are automatically returned in the stake pools for the same period. Our stake pools have better resilience, are geographically better distributed and our pledge (flesh in the game) is larger. We are running in total 10 nodes (2 stake pools, 6 relays and 2 hidden relays) for the same fixed costs of 340 ADA.

Can you tell us why delegators still choose to stake their ADA with these stake pools? We are curious to know since we put a constant effort in our stake pools, marketing of our pools and educating the community without much success. What are we missing here? let us know.

Support us in our commitment to the Cardano ecosystem, stake in our secure and safe stake pools and join our telegram group to stay updated with our latest developments.